The smart Trick of Social Security account That Nobody is Discussing

Wiki Article

The eligibility method demands a sure number of credits (based on earnings) to have been acquired In general, and a certain amount inside the ten several years right away previous the disability, but with far more-lenient provisions for more youthful employees who come to be disabled ahead of getting had an opportunity to compile a lengthy earnings heritage.

In 2009, the Business office of your Main Actuary of your SSA calculated an unfunded obligation of $15.one trillion with the Social Security plan. The unfunded obligation would be the distinction between the longer term cost of the Social Security software (according to a number of demographic assumptions for example mortality, work force participation, immigration, and age expectancy) and full property in the Have confidence in Fund provided the expected contribution amount as a result of The existing scheduled payroll tax.

The percentage of taxes gathered from the worker for Social Security are often called "trust fund taxes" as well as employer is necessary to remit them to the government. These taxes choose precedence above every little thing, and signify the one debts of an organization or LLC that could impose individual liability upon its officers or managers.

Ms. Birenbaum right away started off producing phone calls to established issues correct. When she eventually linked having a Social Security consultant from an area Workplace in the Bloomington, Minn., the rep casually mentioned that this happens “all the time.”

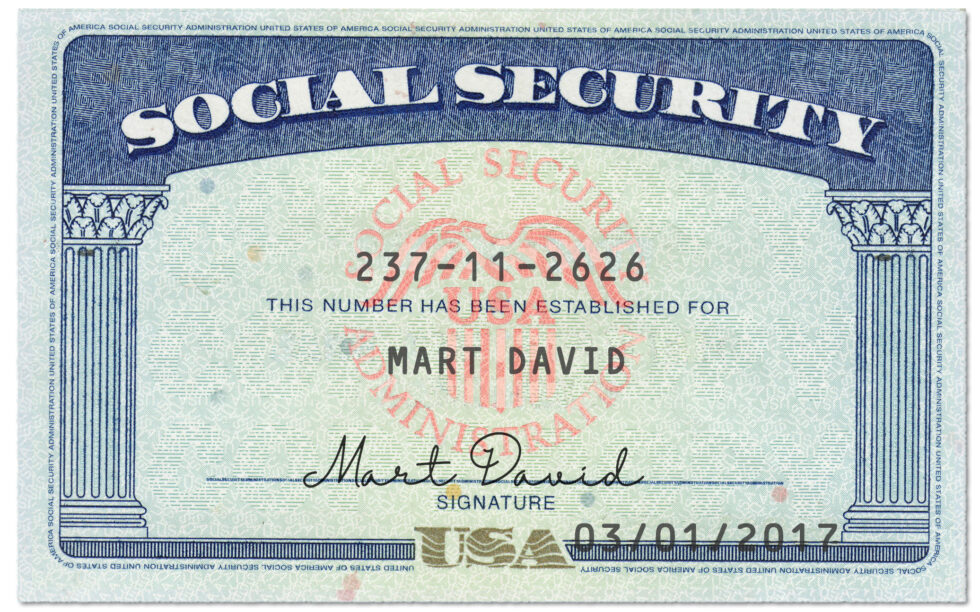

All submitted files need to be possibly originals or Qualified copies via the issuing company. We are not able to take photocopies or notarized copies of files. All documents might be returned to you. We hope this aids!

There has been debate a couple of trust fund depletion state of affairs pertaining to regardless of whether monthly Gains would be reduced or whether complete quantities could be paid out although not on the well timed basis.[34]

Our workers will never threaten you for data or promise a reward in exchange for personal information or funds.

The SSA can even redact (blackout) dad and mom’ names on an SS-five software unless you can provide proof the mom and dad are deceased or equally Have a very beginning date greater than 120 years back.

The leak purports to offer A great deal of the knowledge that financial institutions, insurance policies businesses and service vendors look for when click here building accounts — and when granting a ask for to alter the password on an existing account.

Threaten you with arrest or legal action simply because you don’t agree to fork out cash promptly. Suspend your Social Security variety.

To shield the privateness of residing people today, there are specific specifications for SS-five requests involving "Intense age."

[96] University of California Retirement Program retirement and disability approach Added benefits are funded by contributions from both members along with the College (normally five% of income Each individual) and via the compounded investment earnings on the accrued totals. These contributions and earnings are held inside a have confidence in fund which is invested. The retirement Advantages are much more generous than Social Security read more but are considered to get actuarially seem. The primary distinction between state and local governing administration sponsored retirement methods and Social Security would be that the state and local retirement units use compounded investments that are frequently seriously weighted in stock current market securities, which historically have returned a lot more than 7.0%/year on ordinary Regardless of some decades with losses.[ninety seven] Short-term federal authorities investments could be safer but shell out Considerably reduce ordinary percentages. Almost all other federal, state and local retirement programs get the job done in an analogous trend with diverse profit retirement ratios. Some programs are actually combined with Social Security and they are "piggy backed" along with Social Security Rewards. By way of example, The present Federal Workforce Retirement Method, which covers the overwhelming majority of federal civil service staff employed after 1986, combines Social Security, a modest outlined-gain pension (1.1% per annum of company) and the described-contribution Thrift Savings Prepare.

Also, it is crucial to notice that the online application procedure doesn't get the job done if you should deliver proof of Dying.

Originally the advantages acquired by retirees weren't taxed as cash flow. Beginning in tax calendar year 1984, With all the Reagan-era reforms to maintenance the technique's projected insolvency, retirees with incomes more than $25,000 (in the case of married persons submitting individually who did not live With all the partner Anytime in the course of the calendar year, and for people filing as "single"), or with put together incomes about $32,000 (if married filing jointly) or, in selected cases, any earnings quantity (if married submitting individually in the husband or wife in the year through which the taxpayer lived While using the spouse Anytime) generally noticed part of the retiree benefits matter to federal money tax.